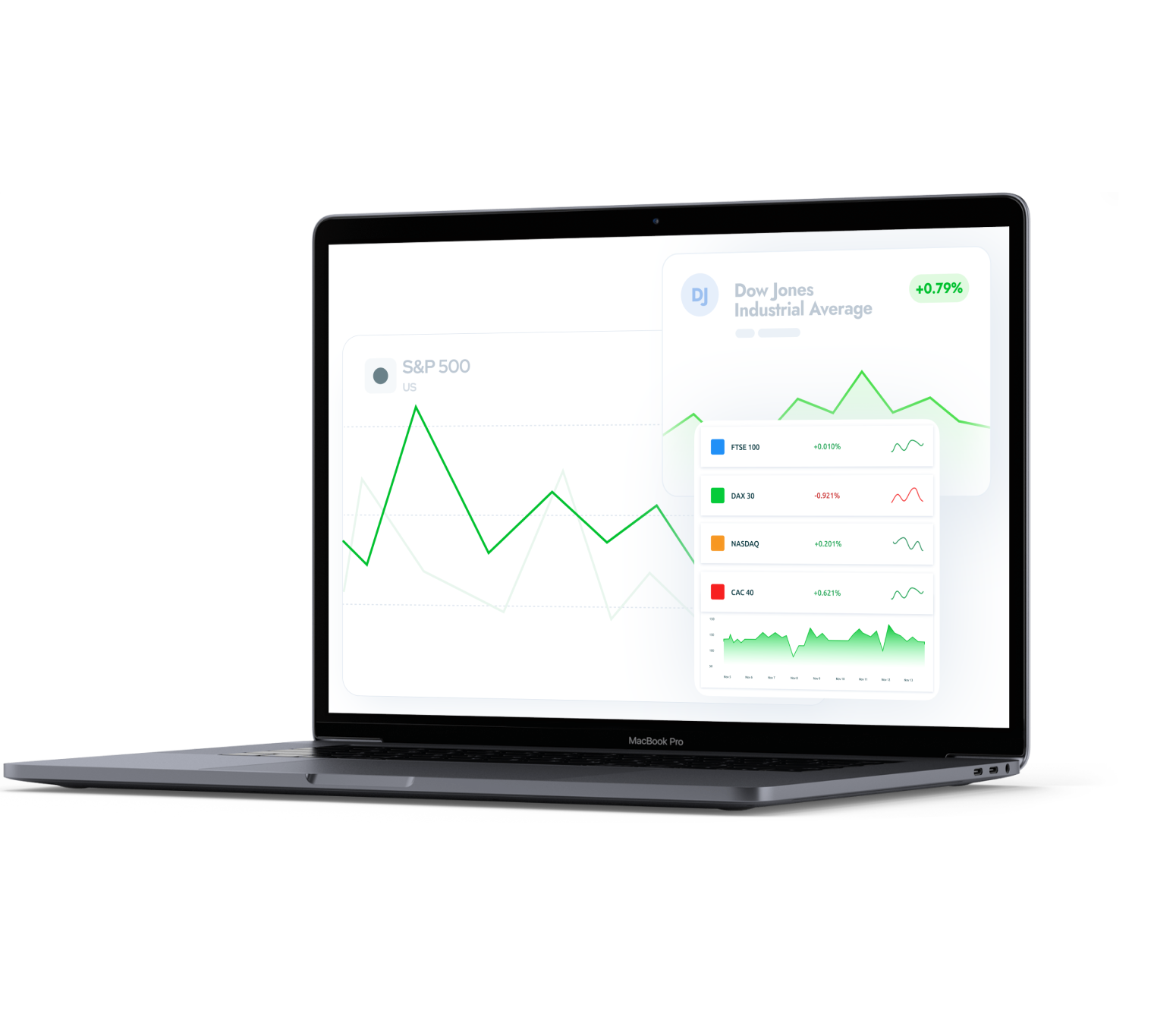

Indices

Discover and trade global indices with Amega!

Start trading nowTrading involves high levels of risk

Dynamic leverage of up to 1:1000

Spreads from 0.8

Minimum order lot - 0.01

Negative Balance Protection

Fast execution of 0.1 seconds

Indices instruments available

What is indices trading?

An index is the price performance measurement of a group of shares or, put more simply, the accumulated value of a group of companies. For example, a popular index is S&P 500, which is a measurement of the accumulated value of 500 large-cap companies in the USA.

Pair

Buy

Sell

Spread

Change, %

Looking for other assets?

Press the buttons below!

Currencies

Dive into the wonderful world of forex! Trade on countless currency pairs with competitive spreads and ideal market conditions!

Precious metals

Expand your trading portfolio with precious metals such as gold, silver, platinum and more!

Commodities

Explore a wide range of tradable agricultural commodities such as cocoa, sugar, coffee, cotton and many more.

Energy

Get on board with the most sought-after energy commodities in the world, and trade on oil and gas today!

Why trade indices with Amega?

No commission fees

Trade hundreds of assets with zero commission fees!

Loyalty cashback program

Our loyalty cashback program offers monetary rewards based on your trading volume, regardless of market direction! (only applies to forex and precious metal markets)

No trading restrictions

At Amega, we welcome all trading strategies, including expert advisors, scalping, and any other trading tactics that will give you an edge!

No playing favorites!

All of our accounts offer the best market conditions available, regardless of your deposit amount!

A-MEGA Bonus!

Get up to 150% of your deposit as an added bonus!

MT5 platform, WebTerminal

Access to the world's most powerful trading platform

Trading involves high levels of risk

FAQ

Got a question? We are happy to help.

Stocks refer to individual companies, while indices represent a group of companies under a common “theme.” For example, the Nasdaq Composite index is made up of all technological companies traded on the Nasdaq Stock Exchange.

In most cases, trading indices is less risky than trading individual stocks, as indices are not susceptible to sudden, significant changes in their daily value (for example, unlike individual stocks, it is highly unlikely that an index will rise or fall by 10% in one day)

The price of an index is directly impacted by the performance of all the companies within it. An index which includes stocks of one or more companies thriving at the same time is likely to increase in value, while the opposite means that it would decrease in value.

When trading indices, you are not only trading a specific stock, but an entire group of stocks, which means you can make a profit from the changes in their combined value, rather than an individual value.

Here are three examples:

The Dow Jones (30 most traded industrial companies)

The NASDAQ (all the technological companies traded on the Nasdaq stock exchange)

The S&P 500 (500 large-cap companies in the USA)

Zero fees for deposits and a range of withdrawal options